Chris Stout

Founder and CEO of StoutCap

Chris Stout has been investing in real estate for 15 years. Over his career, he has accumulated over $60,000,000 worth of real estate. Chris has an extensive construction and ground-up development background which differentiates him from other real estate operators. He has developed numerous properties from raw land to fully constructed and occupied homes and apartments. This is a skillset that is invaluable when operating real estate.

Follow Chris on Social Media

What our Investors have said

“Thoroughly impressed with all aspects of Stout Capital. The way the assets are organized online, the efficient reporting and descriptions, and just how readily the information is available that I need to make investment decisions.”

- Josh M.

Investor

“I Invested twice with Stout Capital. The process is super easy and Chris explained every deal in a clear and concise manner… plus I am doubling my money and getting a tax break.“

- Victor M.

Investor

“I have known Chris Stout for almost 10 years. I have enjoyed watching him grow personally and professionally throughout these years. He is constantly trying to learn new things, and push the boundaries of what he can achieve. His positive energy, talent to remain humble, and the “keep it simple, but calculated” approach to investing has made him stand out in the Real Estate Arena.”

- Dom C.

Investor

About StoutCap

StoutCap privately held real estate investment firm with a nationwide platform focused on acquiring and managing multifamily assets throughout the high-growth markets in the United States. We seek to deliver attractive, risk-adjusted returns to our investors by identifying market opportunities and optimizing asset performance, all while improving the resident experience through a variety of value-add strategies.

Our team has over 40 years of combined experience and includes real estate investment professionals who have overseen the deployment of $800 million in equity and over $4 billion of debt transactions for various institutional funds. Our years of experience, along with a strong aptitude of seeing the industry in a different light – give StoutCap an innate advantage.

OUR

RECENT ACQUISITIONS

Willow Park Apartments

Units: 56

Year Built: 2001

Closing Date: 06/28/2023

Amora West Apartments

Units: 146

Year Built: 1977

Closing Date: 03/02/2023

Amora East Apartments

Units: 117

Year Built: 1971

Closing Date: 11/29/2022

Lakeshore Apartments

Units: 60

Year Built: 2002

Closing Date: 10/27/2022

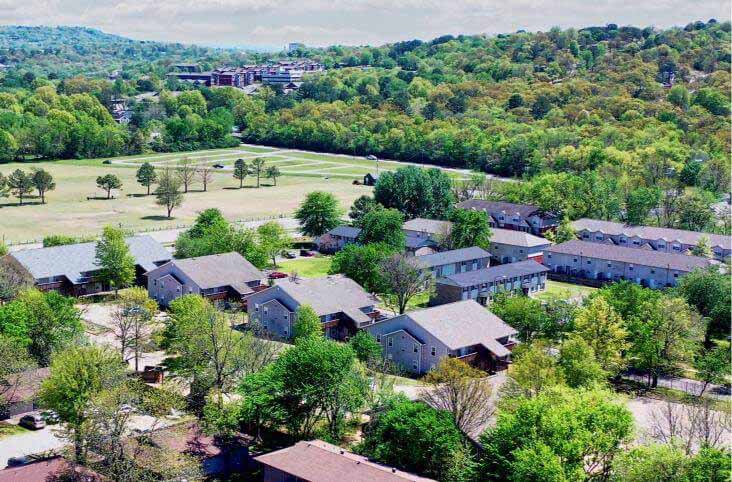

Huntsville Portfolio

Units: 142

Year Built: 1980

Closing Date: 12/15/2021

Frequently Asked Questions

What is Stout Capital and how does is work?

StoutCap applies a value-oriented philosophy to investing, which delivers superior, risk-adjusted returns. StoutCap is financed by accredited investors seeking a combination of strong cash flow and equity growth.

We purchase multifamily assets with a very specific set of criteria – manage them effectively and efficiently – and distribute cash flow to investors.

Can I invest with my self-directed IRA or other retirement account?

Yes! We can process investments through a variety of self-directed retirement accounts.

Can Stout Capital accept 1031 proceeds?

Does any depreciation or losses get passed through the investor?

What I am investing in?

StoutCap offers investors the opportunity to invest in single-asset offerings for attractive multifamily assets.

When you buy shares in one of our offerings, you become a direct equity owner of the LLC that owns the properties.

How will investor reporting work?

Investors will receive access to their investor portal where they can review their investment details and relevant documents at any time.

Investors will also receive monthly update emails with high level financial overview benchmarked against our performance targets along with detailed, property specific updates.

What tax document should I expect to receive?

StoutCap is a real estate investment firm that assists accredited investors in passive real estate investments. Please note that StoutCap is not affiliated with or endorsed by Facebook. Any references to Facebook on this landing page are for advertising purposes only. All interactions with StoutCap are governed by our own terms and policies, which can be found on our website. We encourage you to review our information carefully, conduct due diligence, and consult with financial professionals before making any investment decisions. Investments involve risks, and StoutCap is dedicated to providing accurate information independently of Facebook.